Cassiopea Partners is acting as sole financial advisor to Cantiere del Pardo S.p.A. (“Cantiere del Pardo”, “CdP”, or the “Company”) and its shareholders on the sale of a majority stake to Calzedonia Holding S.p.A. (“Calzedonia Group”).

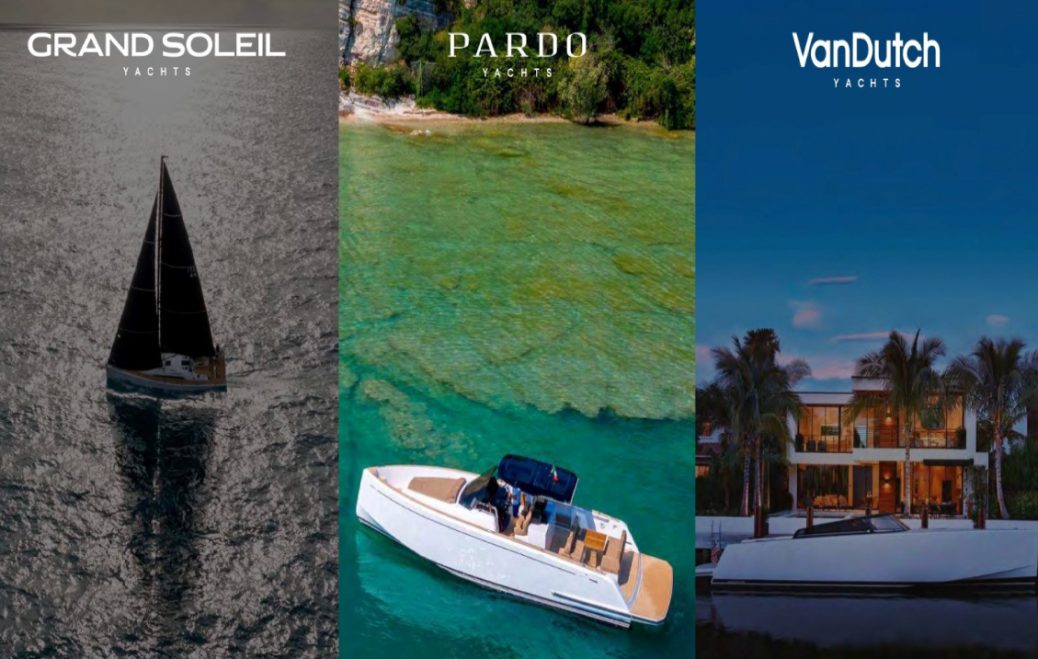

Founded in 1973, Cantiere del Pardo has a history of great success and international recognition. Since its inception, it has sold more than five thousand boats under the Grand Soleil brand and, more recently, under the Pardo Yachts and VanDutch brands. Cantiere del Pardo is recognized as one of the best luxury yacht manufacturers in the world, thanks to its history and tradition, deep conceptualization and construction knowledge, and the iconic design of its models.

The Company has grown significantly both in revenues and corporate structuring since the arrival of Wise Equity (“Wise”) as an investor in 2020, which was also advised by Cassiopea Partners. In particular, the success of the motoryachts line Pardo Yachts, conceived in-house and developed with the collaboration of prestigious design firms, can be considered one of the greatest successes in the recent history of global yachting, given the significant growth from the introduction of the first motoryacht model in 2017 to the projected sale of more than 150 yachts under the Pardo Yacht brand in the current fiscal year.

Gigi Servidati and Fabio Planamente, the two managers and leaders of CdP’s success, will retain a minority stake in the Company continuing the current development strategy based on quality, respect for tradition, service excellence and great attention to sustainability.

With the arrival of Calzedonia Group, Cantiere del Pardo will pursue international growth and the development of new models, with even greater focus on quality and service excellence for both the distribution network and the end customer. CdP will continue to invest in sustainability, innovation and research and development starting from its advanced production sites and its unparalleled human capital.

The Calzedonia Group was founded in Verona in 1986 by Sandro Veronesi, current Chairman and major shareholder. For more than 30 years, the Group has experienced a steady and solid growth in terms of turnover and expansion, creating successful brands and products and establishing itself internationally in fashion retail, reaching a turnover of € 3 billion in 2022. The Group’s collections are present in more than 5,300 monobrand stores under the Calzedonia, Intimissimi, Intimissimi Uomo, Tezenis, Falconeri, Atelier Emé, and Antonio Marras brands, direct or franchised, in 56 countries. Signorvino, a chain of stores specializing in the sale of Italian wines, is also part of the Calzedonia Group.

Gigi Servidati, Chairman of Cantiere del Pardo, has commented: “The acquisition of Cantiere del Pardo by Calzedonia Group represents for all of us a source of pride and satisfaction and, above all, an incentive to pursue with renewed enthusiasm the path of growth started in collaboration with Wise. The entrepreneurial experience and organizational skills of Calzedonia Group will be fundamental to face with confidence and awareness the challenges of a full realization of the strategic objectives of range expansion, optimization of organizational processes and internationalization projects on which we have been working for years to increasingly affirm Cantiere del Pardo as a reality of absolute excellence in one of the most important sectors of Made in Italy. A heartfelt thank you goes to all the colleagues and workers at Cantiere del Pardo who have made this incredible journey possible”.

Fabio Planamente, Chief Executive Officer of Cantiere del Pardo, has commented: “The acquisition by Calzedonia Group opens a new chapter in the long history of Cantiere del Pardo and its successes. We are very honored that such an important and prestigious Italian reality in the world has decided to invest in our shipyard. Thanks to the valuable contribution brought by Wise in the growth path, we are now even more motivated and convinced to face the next challenges and all the new projects, being able to count on a solid Italian group with proven entrepreneurial skills that will bring Cantiere del Pardo and its brands to establish itself more and more in the global nautical scene as an excellence of Made in Italy”.

Michele Semenzato, Founding Partner of Wise Equity, added: “We are proud to have accompanied CdP’s management team on the exciting growth path the company experienced in recent years. CdP is a fantastic example of excellence in an industry where our country holds a prominent role. Under Servidati and Planamente’s leadership, the company has profoundly evolved from the one we had invested in. The Cantiere del Pardo name and the brands it represents have definitely established themselves in the olympus of the world’s most prestigious nautical brands; the management structure has grown and been significantly strengthened; the model range has been considerably expanded and the production capacity has doubled”.

This transaction remarks Cassiopea Partners’ role as trusted advisor accompanying leading Italian champions on their growth path and the ability to maximize shareholders’ value in one-to-one discussions, further consolidating our track record as M&A sell-side advisor and in the luxury goods segment.

The acquisition will be completed by October 2023.

Alongside Cassiopea Partners, Cantiere del Pardo is being assisted as legal advisor by Simmons & Simmons and by Spada & Partners as accounting and tax advisor.