Cassiopea Partners advises HAT Orizzonte

on the acquisition of Primat S.p.A. from Wise Sgr

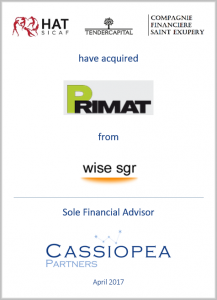

Cassiopea Partners is pleased to announce that it has acted as exclusive financial advisor to HAT Sicaf (“HAT”), Tendercapital e Compagnie Financiere Saint Exupéry Sicav-Sif (together the “Acquirers”) on the acquisition of Primat S.p.A., an Italian leading group in the surface treatment of screws, bolts and fasteners used in different sectors.

Primat S.p.A was founded in 1972 and is specialized in the treatment and coating of screws, bolts, springs, small metal parts intended for various sectors (automotive, hardware, pneumatics fittings, electrical and electromechanical) having very stringent requirements of protection against corrosion. The Company has achieved outstanding operating performances through innovation and thanks to the strong competitive positioning within the reference market.

Ignazio Castiglioni, CEO of HAT, said: “We are pleased to announce the acquisition of another excellent Italian SMEs for reliability and efficiency. The acquisition of Primat is part of a project of aggregation and expansion in Europe, in full accordance with the strategic goals pursued by Wise, aimed at taking Primat to an international leadership position, also thanks to the support of the foreign co-investors of HAT”.

Cassiopea Partners assisted the Acquirers as sole M&A financial advisor and as debt advisor in cooperation with Essentia Advisory.